Medicare 101: Everything You Need to Know Before You Enroll

Medicare 101: Everything You Need to Know Before You Enroll

Medicare enrollment can determine healthcare access and out-of-pocket costs for over 67 million Americans, yet navigating its rules often feels overwhelming. This guide clarifies eligibility criteria and enrollment windows, breaks down Parts A through D, outlines 2025 costs, explains how and when to sign up, compares Medicare Advantage and Medigap, offers strategies to avoid extra charges, and highlights emerging policy trends. By the end, you'll have a clear roadmap for enrolling on time, choosing the right coverage, and preventing costly penalties.

Who Is Eligible for Medicare and When Should You Enroll?

Medicare eligibility determines who can access federal health insurance benefits and when coverage begins, ensuring hospital and medical services under Original Medicare or Advantage plans. Understanding these criteria helps prevent enrollment gaps and late-penalties while guaranteeing coverage starts at the right time. Age, disability status, citizenship, work-credit history, and enrollment periods all influence qualification and timing.

What Are the Age-Based Eligibility Requirements for Medicare?

Turning 65 triggers Medicare eligibility, granting access to Medicare Part A and Part B coverage. Eligibility at 65 requires that you or your spouse have worked and paid Medicare taxes for at least 40 quarters, or you receive Social Security or Railroad Retirement Board benefits.

Be a U.S. citizen or permanent legal resident for five continuous years.

Enroll within your Initial Enrollment Period (IEP), which begins three months before your 65th birthday.

Automatic enrollment applies if you already receive Social Security benefits.

As you approach 65, organizing documentation and deciding on supplemental coverage lays the groundwork for choosing between Original Medicare and Advantage plans.

How Does Disability Affect Medicare Eligibility Before Age 65?

Disability-based eligibility grants access to Original Medicare after a two-year waiting period on Social Security Disability Insurance (SSDI). Individuals with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS) qualify immediately upon meeting SSDI definitions.

ESRD patients can enroll three months before dialysis or transplant.

ALS diagnosis triggers automatic Part A and Part B coverage without the 24-month delay.

Disability eligibility ensures timely access to lifesaving treatments, linking your health needs directly to federal insurance support.

What Are the Citizenship and Residency Requirements for Medicare?

Qualifying for Medicare mandates U.S. citizenship or lawful permanent residency for at least five consecutive years. Non-citizens with valid visas may qualify if they meet residency duration and work-credit criteria. Maintaining continuous residency safeguards uninterrupted coverage and avoids complications at enrollment.

How Do You Qualify for Premium-Free Medicare Part A?

Premium-free Part A applies when you or your spouse have 40 quarters of Medicare tax contributions. Spousal eligibility can grant premium-free Part A even if you haven't worked directly. Without sufficient work credits, Part A premiums may apply, making this qualification essential for minimizing initial costs.

When Is the Initial Enrollment Period and What Happens If You Miss It?

The IEP spans seven months: three months before turning 65, your birth month, and three months after. Enrolling during IEP ensures Part A and Part B start promptly. Missing IEP triggers the General Enrollment Period and may incur late-enrollment penalties, leading to higher lifelong premiums and coverage delays.

Medicare Eligibility and Enrollment Requirements

Medicare eligibility generally begins at age 65 for U.S. citizens or permanent legal residents who have lived in the U.S. for at least five continuous years and have sufficient work credits. Individuals receiving Social Security Disability Insurance (SSDI) may qualify before age 65 after a two-year waiting period, with exceptions for End-Stage Renal Disease (ESRD) and Amyotrophic Lateral Sclerosis (ALS). The Initial Enrollment Period (IEP) spans seven months around one's 65th birthday, and missing it can lead to late enrollment penalties.

This information confirms the criteria for Medicare eligibility based on age, disability, citizenship, and work history, as well as the critical timing for initial enrollment to avoid penalties, aligning with the article's guidance.

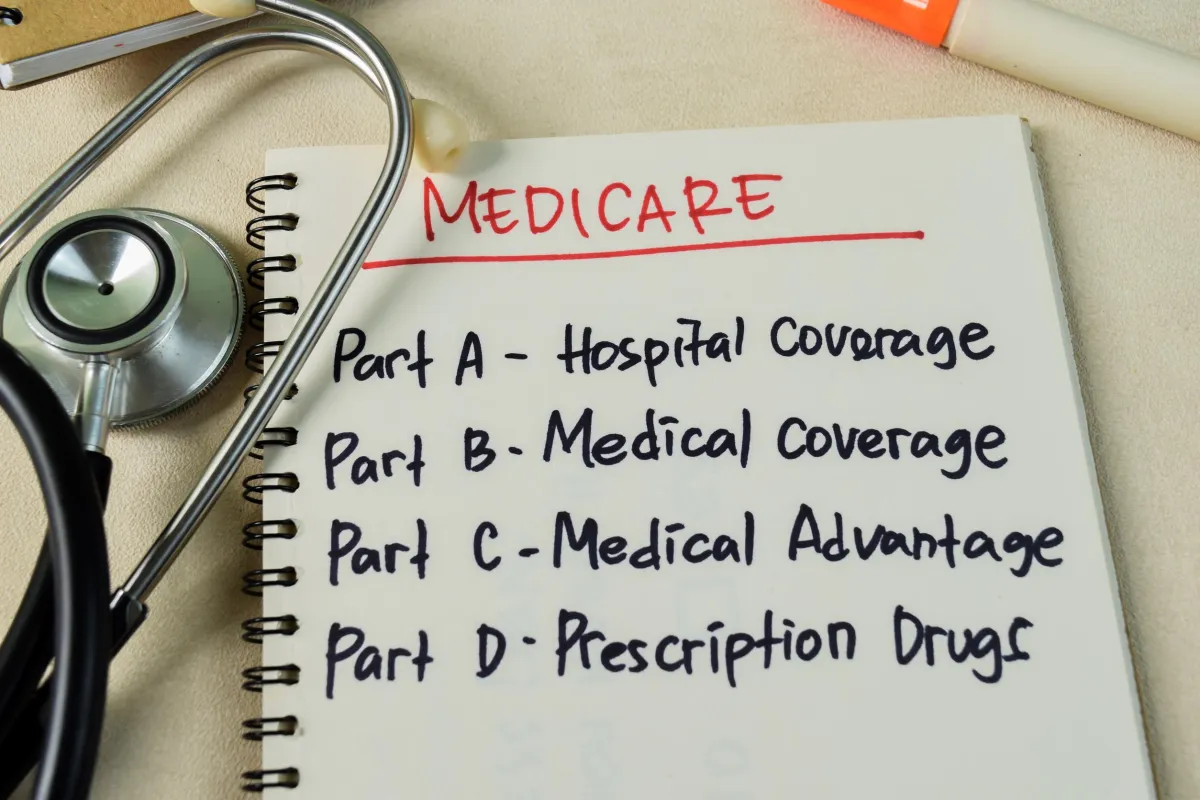

What Are the Four Parts of Medicare and What Do They Cover?

Medicare’s four parts segment coverage into hospital, medical, managed care, and drug benefits, each with unique costs and services. Recognizing these distinctions empowers informed plan selection and cost management.

What Does Medicare Part A Cover and What Are Its Costs?

Part A provides hospital insurance, covering inpatient stays, skilled nursing facility care, hospice, and home health services. The 2025 inpatient deductible is $1,676 per benefit period, with coinsurance for extended stays. Premium-free eligibility often applies based on work history, minimizing upfront expenses.

What Services Are Included in Medicare Part B and What Are the Associated Costs?

Part B covers doctor visits, outpatient care, preventive services, and durable medical equipment. In 2025, the standard Part B premium is $185 per month with a $257 annual deductible. Income-Related Monthly Adjustment Amount (IRMAA) may increase premiums for higher earners, so understanding your income bracket is critical for budgeting.

How Do Medicare Advantage Plans (Part C) Work and What Benefits Do They Offer?

Part C bundles Part A and Part B, often including Part D and extra benefits—such as vision, dental, hearing, and wellness programs—through private insurers. Members may face network restrictions and referrals in HMO or PPO structures but benefit from out-of-pocket maximums absent in Original Medicare.

What Is Medicare Part D and How Does Prescription Drug Coverage Work?

Part D plans cover outpatient prescription drugs via formularies that categorize medications into tiers with varying copayments. Costs include monthly premiums, annual deductibles, and potential coverage gaps ("donut hole"). Choosing a plan aligned with your prescriptions reduces out-of-pocket spending.

How Does Original Medicare Compare to Medicare Advantage Plans?

Original Medicare allows unrestricted provider choice and nationwide coverage, while Advantage plans offer bundled benefits and caps on annual out-of-pocket costs. Trade-offs include cost predictability versus network flexibility, so evaluating your care preferences guides the right decision.

How Much Does Medicare Cost in 2025?

Anticipating 2025 costs helps manage premiums, deductibles, and out-of-pocket responsibilities across coverage options. Comparing expense components clarifies budgeting needs for each Medicare part and supplemental plans.

What Are the Premiums, Deductibles, and Coinsurance for Medicare Part A?

Most beneficiaries pay no Part A premium but incur a $1,676 deductible per hospital benefit period. Extended inpatient stays cost daily coinsurance starting day 61 of hospitalization. Understanding these figures prevents surprise bills during extended care.

How Are Medicare Part B Premiums and Deductibles Calculated, Including IRMAA?

Part B premiums are tiered by income, with the baseline set at $185 for 2025 and a $257 annual deductible. Higher-income beneficiaries pay additional IRMAA surcharges based on tax-reported earnings, making income planning essential for predictable premium costs.

What Are the Costs Associated with Medicare Part D Prescription Drug Plans?

Part D costs include a monthly premium (averaging $46.50 in 2025), an annual deductible (up to $590), and tiered copayments. The coverage gap starts after $4,660 in total drug spending and ends at $7,400, when catastrophic coverage lowers copays significantly.

How Much Do Medicare Advantage Plans Cost and What Are Their Out-of-Pocket Limits?

Advantage plan costs vary by insurer, but many feature $0 premiums. Copays for services and prescription drugs apply until reaching an annual out-of-pocket maximum, capped federally at $9,350 in 2025. This limit protects against excessive medical expenses.

What Are Medigap Plan Costs and How Do They Supplement Original Medicare?

Medigap supplement plans—standardized A through N—cover deductibles, coinsurance, and copayments left by Original Medicare. Premiums differ by plan letter, region, and underwriting criteria. Enrolling during your Medigap Open Enrollment Period secures guaranteed issue rights and consistent pricing.

Understanding Medicare Costs in 2025

Official figures for 2025 indicate that the Medicare Part A inpatient hospital deductible is $1,676 per benefit period. The standard monthly premium for Medicare Part B is $185, with an annual deductible of $257. For Medicare Part D, the standard deductible is $590, and the estimated national average monthly premium for stand-alone plans is $46.50. The maximum out-of-pocket limit for Medicare Advantage plans for in-network services is set at $9,350 in 2025.

This research provides the verified 2025 cost figures for Medicare Parts A, B, D, and Medicare Advantage, directly supporting the article's detailed breakdown of expenses.

When and How Can You Enroll in Medicare?

Enrollment periods define when you can start or change coverage to avoid gaps and penalties. Timing your application appropriately ensures immediate benefit activation and cost minimization.

What Is the Initial Enrollment Period (IEP) and How Does It Work?

The IEP spans three months before, the month of, and three months after your 65th birthday. Enrollment during IEP triggers coverage start dates aligned with your birth month and prevents late-enrollment surcharges.

What Is the General Enrollment Period (GEP) and Who Should Use It?

The GEP runs from January 1 to March 31 each year for those who miss their IEP without SEP eligibility. Coverage begins July 1, and late-penalties for Part B and D may apply, emphasizing the importance of timely enrollment.

What Are Special Enrollment Periods (SEP) and Which Life Events Qualify?

SEPs allow enrollment outside standard windows for events like employer coverage loss, moving, or qualifying for disability. Documenting qualifying events avoids late penalties and maintains continuous coverage.

How Does Automatic Enrollment Work for Medicare Beneficiaries?

Individuals receiving Social Security or Railroad Retirement benefits before age 65 are automatically enrolled in Part A and Part B starting their IEP. Opt-outs require active declines, so understanding automatic processes prevents unwanted premium charges.

What Are the Steps to Enroll in Medicare for the First Time?

Enrolling through the Social Security Administration involves:

Gathering proof of age, citizenship, and work history.

Completing Form CMS-40B (Part B) if delaying Part A enrollment.

Submitting applications online, by phone, or at your local SSA office.

Following these steps ensures seamless coverage activation on your desired start date.

How Do Medicare Advantage Plans Compare to Medigap Insurance?

Comparing Advantage plans and Medigap reveals trade-offs between managed care benefits, provider choices, and out-of-pocket protections. Understanding structure and costs guides optimal coverage selection.

What Are the Key Differences Between Medicare Advantage and Medigap?

Medicare Advantage integrates Parts A, B, and often D with additional benefits and annual out-of-pocket limits, while Medigap supplements Original Medicare by covering cost-sharing. Advantage may restrict provider networks; Medigap allows any provider accepting Medicare.

What Types of Medicare Advantage Plans Are Available?

Advantage plan options include:

HMO: Fixed network, primary care referrals required

PPO: Wider network, out-of-network coverage at higher cost

SNP: Tailored for chronic or dual-eligible beneficiaries

PFFS: Sets flexible payment terms with participating providers

Choosing the right type balances flexibility against premiums and copays.

What Do Standardized Medigap Plans Cover and When Should You Buy Them?

Medigap plans A through N offer defined benefits—ranging from basic coverage in Plan A to comprehensive gap coverage in Plan G. Buying during your Open Enrollment Period guarantees issue rights and standard pricing regardless of health status.

How Do Provider Networks and Referrals Affect Medicare Advantage Plans?

Network restrictions may limit doctor choice, and referral requirements can impact specialist access. Reviewing network directories and referral rules helps anticipate care pathways and potential access barriers.

Which Plan Is Best for You: Medicare Advantage or Medigap?

Selecting between Advantage and Medigap depends on your healthcare utilization, provider preferences, risk tolerance for OOP costs, and desire for extra benefits. Those seeking predictable budgeting and broad provider access often favor Medigap, while individuals prioritizing bundled perks and cost caps may choose Advantage.

How Can You Avoid Medicare Penalties and Extra Costs?

Penalty avoidance hinges on timely enrollment, maintaining creditable coverage, and understanding income-based adjustments. Proactive planning preserves affordable premiums and prevents lifelong surcharges.

What Are the Late Enrollment Penalties for Medicare Part B and Part D?

Missing IEP triggers a Part B penalty of 10% per 12-month delay, applied for the life of Part B enrollment. Part D penalties equal 1% of the national base premium ($46.50) for each uncovered month, ensuring that delaying enrollment incurs higher ongoing costs.

How Does Income Affect Medicare Part B Premiums Through IRMAA?

IRMAA surcharges increase Part B premiums for those with modified adjusted gross incomes above set thresholds. Filing accurate tax returns and exploring appeal rights for life-changing events can mitigate IRMAA impacts.

What Is Creditable Coverage and How Does It Help Avoid Penalties?

Creditable coverage from employer or union plans that meets or exceeds Part D actuarial value delays Part D enrollment without penalty. Obtaining a certificate of creditable coverage ensures proof and smooth SEP activation.

What Are Medicare Savings Programs and Who Qualifies?

Medicare Savings Programs assist low-income beneficiaries by covering Part A and/or B premiums, deductibles, and coinsurance. Qualification depends on state-specific income and asset limits, offering vital relief for those facing financial hardship.

Understanding and leveraging these assistance options secures continuous coverage without undue financial strain.

What Are the Latest Trends and Future Changes in Medicare?

Medicare evolves with shifts in enrollment patterns, quality metrics, digital health adoption, and upcoming policy reforms. Staying informed empowers smarter plan selections and anticipates benefit updates.

How Is Medicare Advantage Enrollment Changing in 2025 and Beyond?

Medicare Advantage enrollment continues to grow, rising to 54% of beneficiaries in 2025, with Special Needs Plans representing a significant share. This trend reflects consumer preference for comprehensive benefits and cost caps absent in Original Medicare.

Trends and Impact of Star Ratings in Medicare Advantage

Medicare Advantage enrollment continues to grow, with over half (54%) of eligible Medicare beneficiaries enrolled in these plans in 2025, a significant increase from previous years. Special Needs Plans (SNPs) represent a growing share of this enrollment. Medicare Star Ratings, issued by the Centers for Medicare & Medicaid Services (CMS), significantly influence a health plan's reputation, member enrollment, and financial performance, with higher-rated plans often attracting more enrollees and qualifying for bonus payments.

This research validates the article's discussion on the increasing enrollment in Medicare Advantage plans and the crucial role of Star Ratings in plan selection and market competitiveness.

What Are the Impacts of Star Ratings on Medicare Advantage Plans?

Star Ratings evaluate plan performance on service quality, member satisfaction, and health outcomes. Higher-rated plans qualify for bonuses and attract more enrollees, making ratings a critical factor in plan selection.

How Are Telehealth and Social Determinants of Health Influencing Medicare Benefits?

Telehealth expansions and coverage for social determinants—like transportation and nutrition—enhance access and preventive care. These innovations improve outcomes and reflect Medicare’s shift toward holistic health management.

What Policy Changes Are Expected for Medicare in 2026?

Proposed 2026 reforms include expanded dental benefits in Part B, updated IRMAA thresholds, and revised Part D formulary protections. Anticipating these updates helps beneficiaries plan for changes in benefits and cost structures.

Medicare’s landscape continues to adapt, underscoring the importance of annual plan reviews and policy monitoring to maintain optimal coverage.

Medicare’s complexity can feel daunting, but understanding eligibility, parts, costs, enrollment steps, and plan differences empowers confident decisions. By enrolling on time, comparing coverage options, and leveraging assistance programs, you can secure comprehensive benefits while minimizing expenses. Keep this guide handy for annual plan evaluations and to stay abreast of policy updates that affect your healthcare coverage.